IBAN (International Bank Account Number) is the standardized format that simplifies global payments. Every account in Oman will now have an IBAN number which will help you facilitate international transactions with ease and without any complications. IBAN plays a crucial role in streamlining cross-border transactions. By using IBAN, you can ensure swift and accurate processing of payments, reducing errors and delays. Whether you’re a business expanding into international markets or an individual conducting transactions abroad, IBAN makes the process smoother and more efficient.

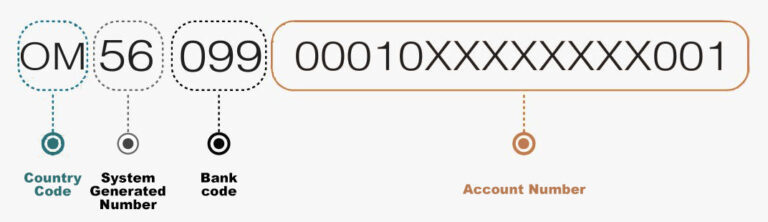

Here, “OM” represents Oman’s country code, followed by 2 check digits and the account number