IBAN Information and Checker

Introduction: IBAN (International Bank Account Number) is the standardized format that simplifies global payments. Every account in Oman will now have an IBAN number which will help you facilitate international transactions with ease and without any complications. IBAN plays a crucial role in streamlining cross-border transactions. By using IBAN, you can ensure swift and accurate processing of payments, reducing errors and delays. Whether you`re a business expanding into international markets or an individual conducting transactions abroad, IBAN makes the process smoother and more efficient.

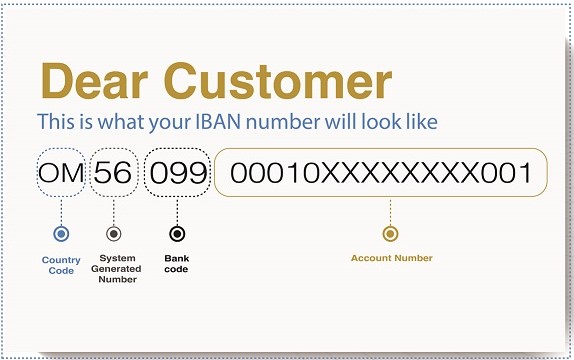

For example, consider a typical IBAN format for an Omani bank account: OM39099XXXXXXXXXXXXXXXX. Here, "OM" represents Oman`s country code, followed by 2 check digits and the 12-digit account number.

Check your IBAN number:

FAQ:

| Question |

Answer |

| What is IBAN? |

IBAN, which stands for International Bank Account Number, is a distinctive identifier generated for each account held with OHB. In Oman, an IBAN consists of 23 digits, comprising the Country Code, Check Digits, Bank Identifier Code, and your existing Bank Account Number. |

| |

|

| Will IBAN replace my current bank account number? |

IBAN does not replace your current Account number. Instead, it includes additional characters placed before your existing bank account number. The complete sequence of alphanumeric digits, including these additional characters, is what is referred to as the IBAN. |

| |

|

| How can I identify the difference between my current account number and my IBAN number? |

An IBAN is distinguishable from a regular account number by the following:

• The first two letters indicate the country code where the account is located.

• The third and fourth positions are two numbers serving as check digits.

• The next three numbers identify the specific bank where the account is held.

• The remaining 16 numeric digits represent the beneficiary`s account number, padded with leading zeros. In Oman, the IBAN is 23 characters long. |

| |

|

| What is the difference between IBAN and SWIFT? |

An IBAN is designed to identify a particular bank account, whereas a SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is used to identify the bank itself. The SWIFT code is crucial for routing international payments between banks, while the IBAN serves the purpose of specifying the exact account where the payment should be deposited. |

| |

|

| How do I benefit from the Iban? |

The primary advantage of IBAN is its role in streamlining the automatic processing of money transfers between IBAN-compliant countries. Banks are mandated to verify the accuracy of the IBAN when initiating fund transfers, ensuring that only transfers with the correct IBAN are processed. |